Source Baisine 61XL cartucho de tinta para Deskjet 2050 2510 2512 2514 2540 impresora de inyección de tinta, Compatible para hp cartucho de impresora 61 on m.alibaba.com

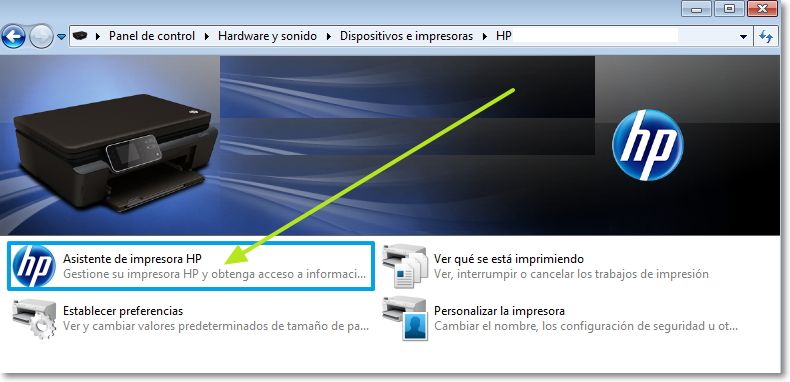

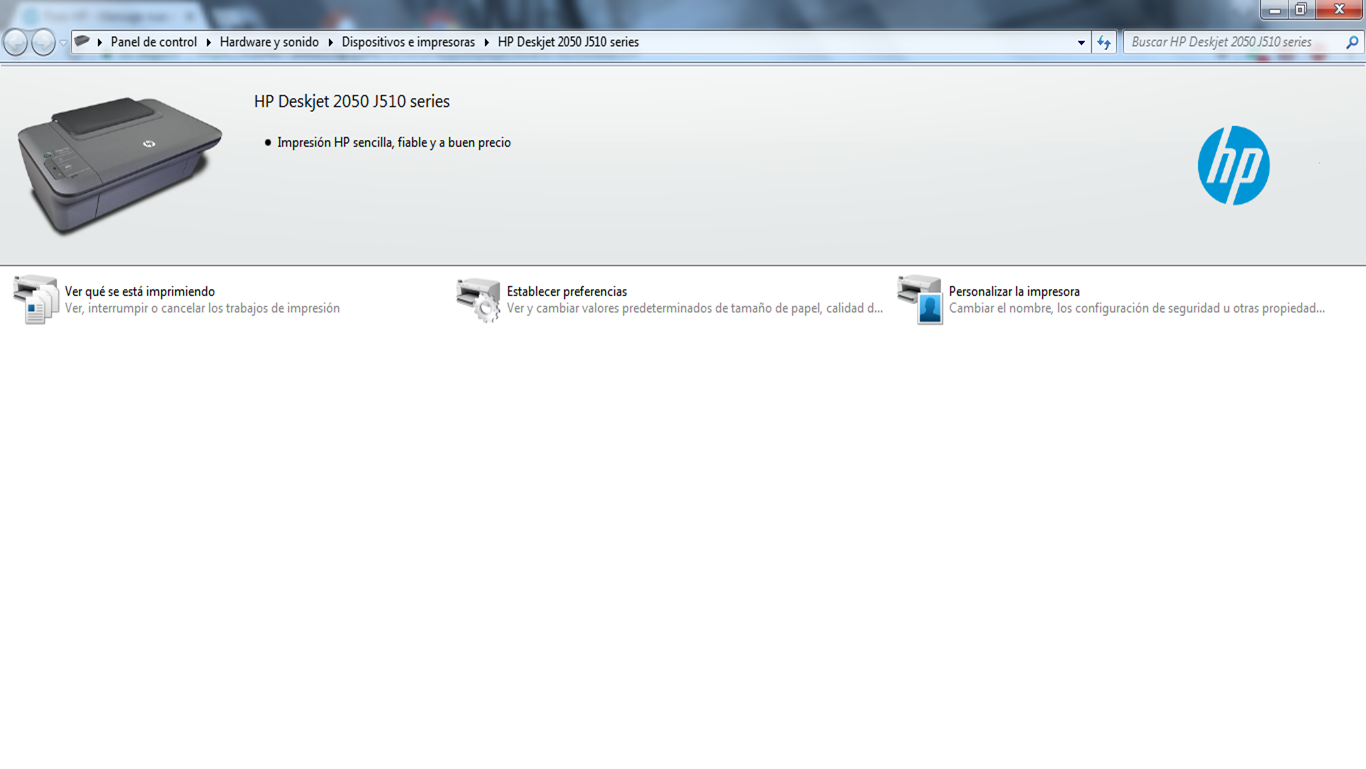

Solucionado: Impresora hp 2050 no abre página de configuración ... - Comunidad de Soporte HP - 790773

Impresora de tinta Deskjet 2050, 122 122 x l tinta de tinta compatibles para HP DeskJet 2050 tc126 tinta de alta calidad : Amazon.com.mx: Oficina y papelería

Cartuchos de tinta recargables para impresora hp 802XL Deskjet 3050, 2050, 2000, 1510, 1050, 2 uds., #02, hp 1010 - AliExpress

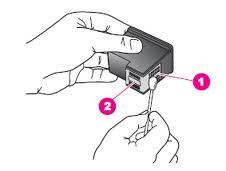

Reemplazando un cartucho de impresión - Impresora Todo-en-Uno HP Deskjet 2050 | HP Support - YouTube

Source Compatible hp 121 122 xl cartucho de tinta para hp deskjet serie d2563 impresora para 1000, 2000, 2050, 3000, 3050, tinta de tinte on m.alibaba.com